Ratio analysis is a useful management tool that will improve your understanding of financial results and trends over time and provide key indicators of organizational performance. Ratio analysis Performance ratios Financial leverage ratios Profitability ratios Efficiency ratios. Whether youre just starting out or are more advanced learn ways to determine the intrinsic value of a security by examining related economic financial and other qualitative and quantitative. Managers will use ratio analysis to pinpoint strengths and weaknesses from which strategies and initiatives can be formed. 23 Full PDFs related to this paper. An activity ratio relates information on a companys ability to manage its resources that is its assets efficiently. Fundamental analysis offers a sound intellectual. Fundamental analysis is a method of evaluating a security in an attempt to measure its value by examining related economic financial and other qualitative and quantitative factors. A fundamental perspective is important because the stock prices of a fundamentally. Activity Inventory Cost of goods sold Inventory turnover Accounts receivable Sales on credit Accounts receivable turnover Total assets Sales Total asset.

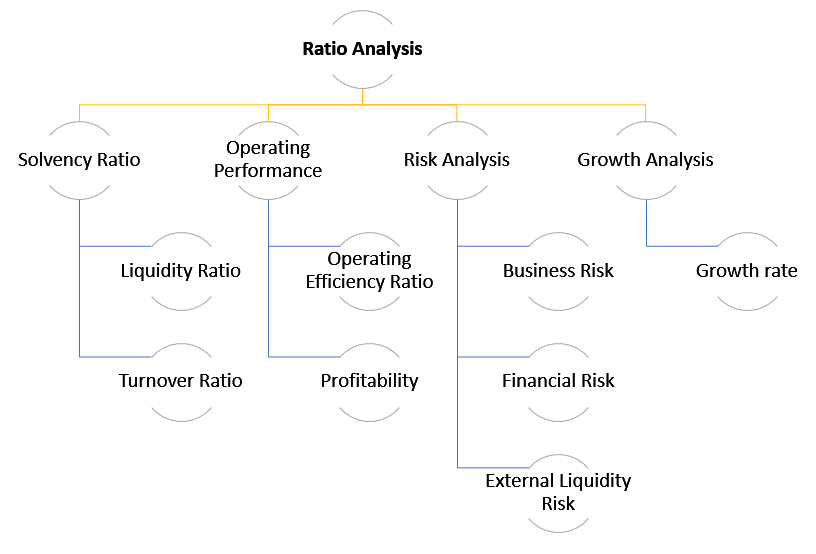

Fundamental analysis offers a sound intellectual. Activity Inventory Cost of goods sold Inventory turnover Accounts receivable Sales on credit Accounts receivable turnover Total assets Sales Total asset. A short summary of this paper. It allows the user to do most of the essential fundamental analysis. RATIO TREND ANALYSIS A. Price-to-Sales PS Value of revenue. A financial leverage ratio provides information on the degree of a companys fixed financing obligations and its ability to satisfy these financing obligations. For stocks financial statements include revenues future growth balance sheets income statements profit margins cash flow statements and other relevant data. Financial analysis is the process of using fi nancial information to assist in investment and fi nancial decision making. Components of ratio analysis Ratio analysis covers two basic groups.

A shareholder ratio describes the companys financial condition in terms of amounts per. Macro Economics Major Trends You dont want to be invested in a typewriter company in this age. Provides Fundamental Analysis and Recognia Technical Analysis to save time on research and provide an overall assessment of a companys valuation quality growth stability and financial health. Download Full PDF Package. Managers will use ratio analysis to pinpoint strengths and weaknesses from which strategies and initiatives can be formed. Empirical and tested evidence suggests that fundamental and ratio analysis is a powerful ally in the hands of an active and savvy investor. Ratio analysis is a useful management tool that will improve your understanding of financial results and trends over time and provide key indicators of organizational performance. This is a quick financial ratio cheatsheet with short explanations formulas and analyzes of some of the most common financial ratios. Fundamental Analysis Module NATIONAL STOCK EXCHANGE OF INDIA LIMITED. Components of ratio analysis Ratio analysis covers two basic groups.

Net income Net profit margin Sales 4. A financial leverage ratio provides information on the degree of a companys fixed financing obligations and its ability to satisfy these financing obligations. Ratio analysis is a useful management tool that will improve your understanding of financial results and trends over time and provide key indicators of organizational performance. 3 The history of fundamental analysis can be traced back at least. Fundamental Analysis Module NATIONAL STOCK EXCHANGE OF INDIA LIMITED. Managers will use ratio analysis to pinpoint strengths and weaknesses from which strategies and initiatives can be formed. A fundamental perspective is important because the stock prices of a fundamentally. It is also a fundamental step in developing ratio trend and comparative analyses. Financial analysis is the process of using fi nancial information to assist in investment and fi nancial decision making. Fundamental analysis unearthed secrets investors wanted to know Online tools to mak e analysis easier A checklist of things to consider in every annual report A dvice on how a good company in a bad industry can still make you money Why trends are important to.

Take fundamental analysis to a new level. Financial analysis is the process of using fi nancial information to assist in investment and fi nancial decision making. Ratios that provide insight about what the market for shares and bonds believes about future prospects of the fi rm. Fundamental analysis unearthed secrets investors wanted to know Online tools to mak e analysis easier A checklist of things to consider in every annual report A dvice on how a good company in a bad industry can still make you money Why trends are important to. PE Ratio - Closing Stock Price Annual Earnings per share. Fundamental analysis is a method of evaluating a security in an attempt to measure its value by examining related economic financial and other qualitative and quantitative factors. This study is a follow-up study of research on stock prices that have been conducted by researchers but this research focuses on the fundamental analysis of the impact of financial ratios. Whether youre just starting out or are more advanced learn ways to determine the intrinsic value of a security by examining related economic financial and other qualitative and quantitative. Price-to-Sales PS Value of revenue. Ratio analysis Performance ratios Financial leverage ratios Profitability ratios Efficiency ratios.