Post-acquisition profits are profits made and included in the retained earnings of the subsidiary company since acquisition. To calculate the retained earnings at the. In other words it is the difference between the profit or loss account at acquisition and the profit or loss account at the date of consolidation. They are included in group retained earnings. The reserves of S which arose after acquisition by P. Share capital 75x100 75 Retained earning 75x 60 45 120 Group share of goodwill 60 Step 3 group retained earnings RM000 Ps retained earnings 240 s 75 x 130-60 525 2925 Step 4 non-controlling interest RM000 Share capital 25 x 100 25 Retained earning 25 x. When you owned the company that section represented your equity in the company. Pre-acquisition dividend is generally deducted from the cost of the investment. The company has a new owner and that section now represents that persons equity. They are included in group reserves.

Immediately after the acquisition nothing has happened to the subsidiary so there is no change in the post-acquisition subsidiary equity account 3. Access MA financials deal terms companies strategic acquirers and advisory firms. Only the group share of the post-acquisition reserves of S is included in the group statement of financial position ie. They are included in group retained earnings. Plus parents of post acquisition profit 80 x 5000 4000. The earnings cleared the loss and then grew to 1204000. Get information on MA activity in your industry or region. Post-acquisition profits are profits made and included in the retained earnings of the subsidiary company since acquisition. Post-acquisition profits are profits made and included in the retained earnings of the subsidiary company since acquisition. Wholly-owned Subsidiary 100 ownership.

2000 in dividends paid out during the period. Dr Retained earnings 8000 b. When you owned the company that section represented your equity in the company. Pre-acquisition dividend is generally deducted from the cost of the investment. They are included in group reserves. It equals the parents retained earnings purely from its own operations plus parents share in the subsidiarys net income since acquisition. In other words it is the difference between the profit or loss account at acquisition and the profit or loss account at the date of consolidation. They may post a debit entry into the goodwill account if the acquirer paid more than the book value of assets. Suppose u purchase shares of xyz ltd in April 2010 and the company declared dividend on those shares related to the fy 2009-10 that dividend will be received by u because your name is on the. Cr Investment in S 17000 Concluding points.

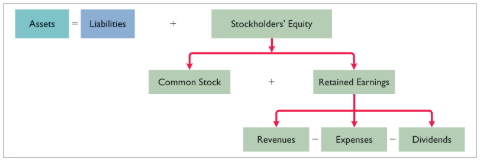

The following example explains the whole process by taking you. Ad See what you can research. Manual posting to Retained Earnings Reserves Account. A retained loss is simply a negative retained profit. Retained earnings is part of the owners equity section of the balance sheet. Retained earnings is part of the owners equity section of the balance sheet. Dr Share capital 9000 c. To recap in answer to the requirements. Dr Retained earnings 8000 b. Post Acquisition Profit This is the increase in the reserves retained earnings of the subsidiary after it has been acquired by the Parent company.

The company has a new owner and that section now represents that persons equity. Your retained earnings simply become the buyers retained earnings. When you owned the company that section represented your equity in the company. The reserves of S which arose after acquisition by P. The company has a new owner and that. Post-acquisition profits are profits made and included in the retained earnings of the subsidiary company since acquisition. Get information on MA activity in your industry or region. 2000 in dividends paid out during the period. 1000-Excess depreciation w7 100. Pre-acquisition dividend is generally deducted from the cost of the investment.