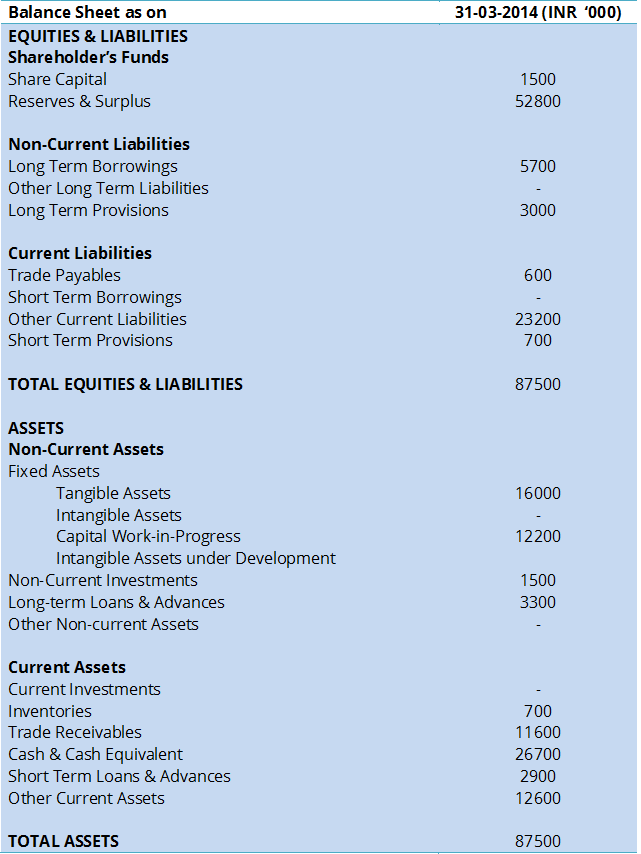

It is a snapshot at a single point in time of. Understanding Analyzing Balance Sheets quantity. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a. A balance sheet is only a snapshot of a business financial position on one particular day. A balance sheet is a financial document designed to communicate exactly how much a company or organization is worthits so-called book value The balance sheet achieves this by listing out and tallying up all of a companys assets liabilities and owners equity as of a particular date also known as the reporting date. The balance sheet also known as the statement of financial position is one of the three key financial statements. Earned net worth analysis Advanced. Three core financial statements. The balance sheet is an annual financial snapshot. Learn how to read a Balance Sheet interpret it do financial analysis and more in 2021.

Interpreting the Income Statement. Three core financial statements. Understanding Analyzing Balance Sheets. This one unbreakable balance sheet formula is always always true. 1999 1299. The balance sheet reports the companys assets liabilities and owners equity at a given point of time. This is the currently selected item. For the balance sheet the total assets of the company will show as 100 with all the other accounts on both the assets and liabilities sides showing as. Learn how to read a Balance Sheet interpret it do financial analysis and more in 2021. Balance Sheet along with the Income Statement and the Cash Flow statement forms the three primary financial statements in accounting.

The balance sheet also known as the statement of financial position is one of the three key financial statements. A balance sheet along with the income and cash flow statement is an important tool for investors to gain insight into a company and its operations. Interpreting the Balance Sheet. This one unbreakable balance sheet formula is always always true. Revenue 50272 49694 Cost of goods sold 37611 37534 Restructuring charges - cost of goods sold 24 -- Gross profit 12637 12160 Selling general and administrative. The volume of business of a bank is included in its balance sheet for both assets lending and liabilities customer deposits or other financial instruments. Interpreting Financial Statements and Measures Balance sheet basics Happy new year. Balance sheet and income statement relationship. Small businesses can read their balance sheets to better understand the companys accounts at a specific moment in time. A bank balance sheet is a key way to draw conclusions regarding a banks business and the resources used to be able to finance lending.

Balance sheet income statement statement of retained earnings and statement of cash flow. Earned net worth analysis Advanced. The balance sheet is separated with assets on one side and liabilities and owners equity on the other. The volume of business of a bank is included in its balance sheet for both assets lending and liabilities customer deposits or other financial instruments. Interpreting Financial Statements and Measures Balance sheet basics Happy new year. Learn how to read a Balance Sheet interpret it do financial analysis and more in 2021. A balance sheet along with the income and cash flow statement is an important tool for investors to gain insight into a company and its operations. It is like a report card to measure a companys performance. The balance sheet is an annual financial snapshot. The balance sheet is unlike the other key financial statements that represent the flow of money through various accounts across a.

Interpreting the Income Statement. It is like a report card to measure a companys performance. The balance sheet reports the companys assets liabilities and owners equity at a given point of time. A look at a balance sheet Interpretation - liquidity Interpretation - balance sheet structure Interpretation - solvency net worth change Asset valuation Advanced. Three core financial statements. The balance sheet is separated with assets on one side and liabilities and owners equity on the other. Using a balance sheet from Intel as your case study survey the significance of specific items that typically appear on balance sheets including current assets and intangible assets. Understanding Analyzing Balance Sheets quantity. The volume of business of a bank is included in its balance sheet for both assets lending and liabilities customer deposits or other financial instruments. A bank balance sheet is a key way to draw conclusions regarding a banks business and the resources used to be able to finance lending.