Non-operating expenses and losses. Non-operating revenues and gains. In accounting the terms sales and is the companys revenue from sales or services displayed at the very top of the statement. Income statement accounts are used to sort and store transactions involving. This contrasts with a balance sheet which shows account balances for one exact date. Income Statement Accounts Multi-Step Format Net sales sales or revenue. This value will be. An income statement would not include A other revenue and gains. Inventory is an asset and its ending balance is reported in the current asset section of a companys balance sheet. The income statement is the most common financial statement and shows a companys.

Non-operating revenues and gains. It lists the total revenues and expenses that occurred over the period leading to a total calculation of how much money was ultimately gained or lost. Inventory is not an income statement account. Income statement accounts are used to sort and store transactions involving. At year-end the company uses a loss on its income statement in order to reduce its overall tax liability. Coffee Roaster Enterprises Inc. This value will be. Income statements include judgments and estimates which mean that items that might be relevant but cannot be reliably measured are not reported and that some. This is a key distinction between the income statement. The taxes on an income statement with this scenario do not affect the information on the income statement.

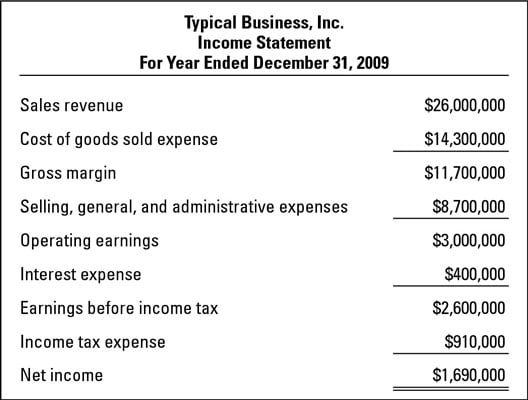

Similarly any repayment of the principal amount will not be an expense and therefore will not be reported on the income statement. Income statements include judgments and estimates which mean that items that might be relevant but cannot be reliably measured are not reported and that some. Cost of goods sold Operating expenses Sales Retained earnings The expense recognition matching principle states that Net income is determined by linking operating cash receipts with operating cash payments assets are linked with liabilities and stockholders equity in the balance. It lists the total revenues and expenses that occurred over the period leading to a total calculation of how much money was ultimately gained or lost. Income Statement Defined. Non-operating expenses and losses. An income statement also called a profit and loss account or profit and loss statement is a report that summarizes a companys revenues and expenses over a specific period of time. Sales Revenue Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services. Common size income statements include an additional column of data which summarizes each line item as a percentage of your total revenue. They relate only to the current period and do not have a lingering financial impact beyond the end of the current period.

This is the value of a companys sales of goods and services. It also shows the companys profit or losses often as the bottom line of the income statement. Inventory is not an income statement account. It lists the total revenues and expenses that occurred over the period leading to a total calculation of how much money was ultimately gained or lost. An income statement does not include which of the following. Companies leave this line blank if there is zero net income or the company loses money for the given period. Non-operating revenues and gains. Similarly any repayment of the principal amount will not be an expense and therefore will not be reported on the income statement. Non-operating expenses and losses. Income statements include judgments and estimates which mean that items that might be relevant but cannot be reliably measured are not reported and that some.

The most common income statement items include. It lists the total revenues and expenses that occurred over the period leading to a total calculation of how much money was ultimately gained or lost. It also shows the companys profit or losses often as the bottom line of the income statement. 2 Income statements can be generated using the cash or. An income statement also called a profit and loss account or profit and loss statement is a report that summarizes a companys revenues and expenses over a specific period of time. This contrasts with a balance sheet which shows account balances for one exact date. The income statement is a results-oriented report showing the net income or loss over a specified period. They relate only to the current period and do not have a lingering financial impact beyond the end of the current period. An income statement would not include A other revenue and gains. The income statement is the most common financial statement and shows a companys.